What’s Ahead for Coal, Iron Ore and Australia

Coal and iron ore are Australia’s two biggest exports. In 2013 iron ore exports earned $69 billion and coal $40 billion, 26% and 15%, respectively, of total exports. Unsurprisingly then, price declines in either commodity result infront page news here in the Land Down Under. Read more about iron ore here and here.

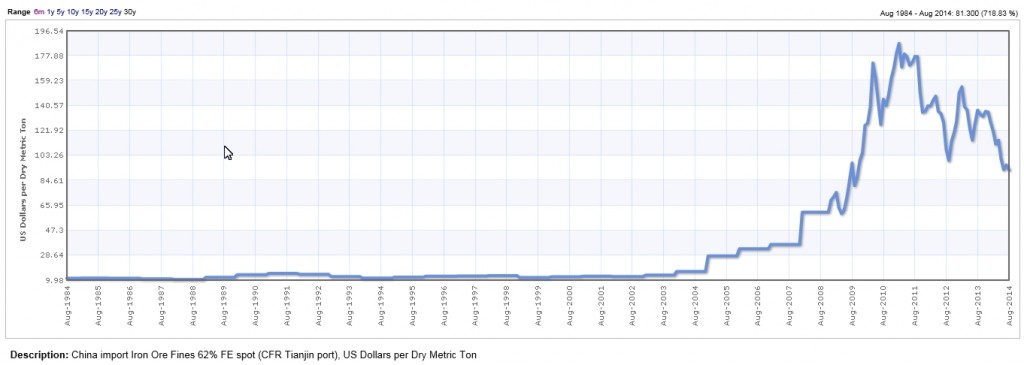

This year iron ore has fallen in price from around USD128 per tonne to USD82 per tonne. This price decline is squeezing the smaller, high cost producers. However, as the chart below shows, even the current price is the higher than it was in mid-2009 and much higher than the pre-GFC period to late 2008.

Chart Courtesy of Index Mundi

The world’s three biggest producers for the seaborn iron ore trade are Vale SA (Brazil), Rio Tinto Limited (Australia) and BHP Billiton Limited (Australia). These three have vastly increased iron ore supply over the past few years, at a time of moderating demand. Some think that this was a deliberate ploy to depress the price and drive out higher cost competitors.

Whether there has been monopolistic behaviour or not, the future for the iron ore price looks average. China mines large amounts of high cost, low grade iron ore. while the industry thinks that at current, and lower, prices Chinese mines will close, I think China is more likely to subsidise if necessary to keep miners and downstream workers employed. Just as the Western world does with agriculture and other industries.

In 1894 the term “riding on the sheep’s back” was first heard: meaning high revenues from sheep’s wool (and other agricultural products) free carried the Australian economy. For the past decade the Australian economy has ridden on the back of hard commodities such as iron ore and coal.

Australia is a country with very high prices for everything, from a glass of beer to a house. Corruption is endemic, particularly in the construction industry. The minimum wage is very high and productivity is low. This has all come about because of the luck of being able to ride on the back of very high priced commodities. This ride will finish soon.

The front page news in Australia yesterday was that China will take measures to curb pollution, endemic in most major cities. One of these measures was to restrict imports of “dirty” thermal coal (coal with high ash content, high sulphur high heavy metals content, etc.). Read more about coal here, here, here and here.

Beijing – almost invisible under a smog blanket

The local mainstream commentariat responded with ‘we’ll all be rooned, said Hanrahan”. This is an Australianism originally referring to a bad drought that was destroying the farming sector, the sheep’s back, as it were. Then later in the day, the same commentariat became much more optimistic. Hey, Australian thermal coal is the best in the world. It’s not.

But China is taking more anti-pollution measures that have not been discussed in Australia. Some examples:

- Forced closure of old and dirty cement, coal and steel plants

- Establishment of environmental courts and large fines for offenders

- A cap on the total amount of coal consumed countrywide

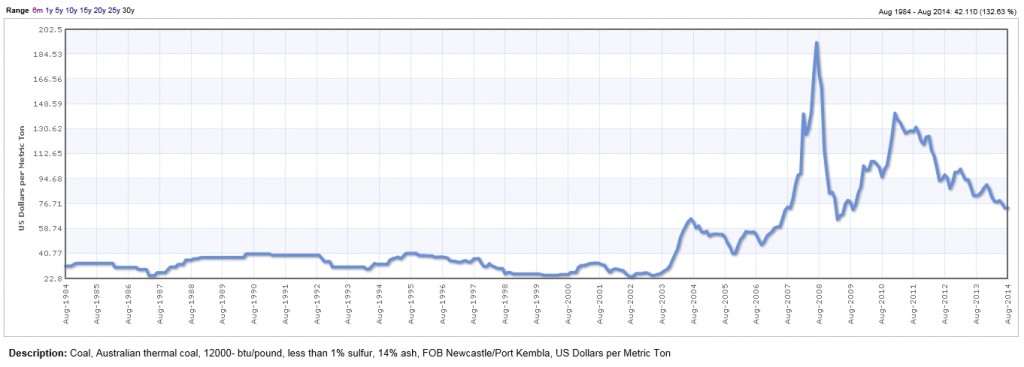

This suggests that the downtrend in the chart below may continue.

Chart Courtesy of Index Mundi

Conclusion

If you need to invest in Australian iron ore then Rio Tinto (“ASX:RIO”) is the only place to be as it is the lowest cost producer. With thermal coal, quality will be king. Look for high calorific value, low ash and low impurities, especially sulphur. Personally, I would look for anthracite opportunities in places such as Russia and South Africa. Read more on anthracite at the coal links above.