Why The Sudden Interest in Contingent Convertible Bonds?

Contingent Convertible Bonds (“CoCos”) have been around since 2009. They were primarily designed by banks and government regulators to meet the regulatory capital eligibility requirements of Basel III (a voluntary regulatory framework principally concerning bank capital adequacy). Most CoCos are bought by retail investors and small private banks.

It is widely though that the interest in CoCos by small investors was a result of high rates of return and an incorrect understanding of the nature of CoCos. I shall briefly explain their nature below. It will become obviously that CoCos are not a bond at all, but a more risky bond/equity hybrid.

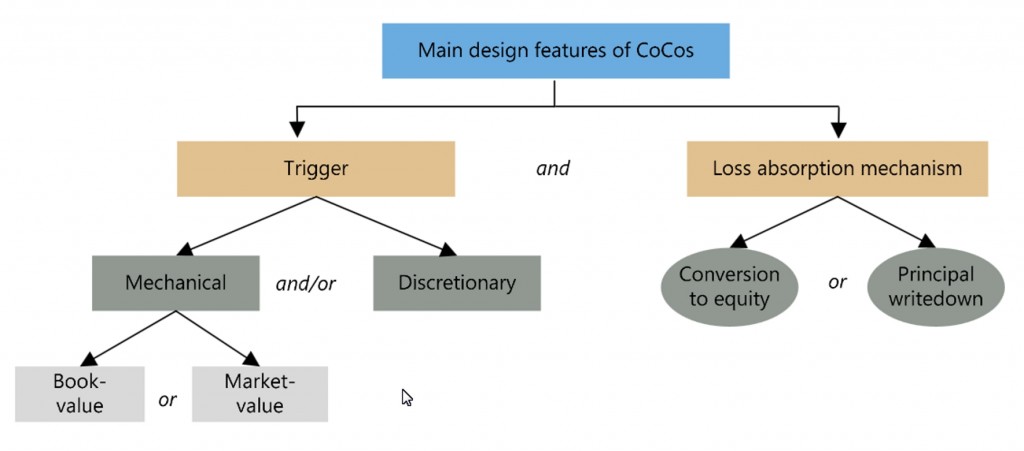

The chart below shows the basic features of CoCos. The loss absorption mechanism is the way the bank reduces the value of a CoCo “bond”. The trigger is the point at which the loss absorption mechanism is activated. A simple example would be where a bank’s share price declines to a trigger price. The Coco is then written down a specified percentage or converted to equity. Either method causes loss to the bond-holder.

Chart Courtesy Bank for International Settlements

Assume an investor has paid, say, €100 for a CoCo with a 6% yield. If all goes well then that’s a good return. If not, a haircut is on the way. That is what has happened to holders of Deutsche Balk CoCos, one of which is shown in the chart below. The €100 is now worth €77, a 23% haircut. The fact that yield is now 7.8% is of no consolation to bond holders. Of course Deutsche has been at pains to say there is no problem. But with the steep decline in the bank’s share price, it is reasonable to assume that a trigger may have been breached. If so, investors could be receiving further trims.

This is Why The Sudden Interest in CoCos – Chart Courtesy fastFT

CoCos can be insured with Credit Default Swaps (“CDS”), but these are under pressure too. The cost to insure Deutsche CoCos has recently soared. And of course there is no guarantee that a CDS would be able to be honoured in the event of CoCo contagion.

The Europeans are not alone in the issuance of large quantities of CoCos, China has also been busy in this space. The Chinese market is somewhat opaque, so the state of its’ CoCos is difficult to determine.

CoCos are an unsuitable investment for retail investors. In fact it is difficult to know who they would be suitable for. Perhaps the very governments involved in their creation.