Specialty Metals and Minerals – Lithium

Lithium is currently one of the most popular members of the periodic table, due to enthusiasm about the growing demand for lithium ion batteries for cars and storage. There is excitement about graphite, for similar reasons. Read more on graphite here.

Lithium is the third element in the periodic table, after hydrogen and helium. It is very light, about half the density of water. It is highly corrosive, flammable and reactive. It is often stored under oil to prevent it reacting with air. It has a high electrochemical potential which means it makes an excellent battery anode.

Lithium was discovered in the mineral petalite (lithium aluminium silicate) in 1817 by Johan August Arfwedson in Stockholm, Sweden. He later showed that lithium was also present in spodumene and lepidolite, two important sources of the metal. Lithium is abundant in the Earth’s crust, about the same as nickel and lead. Lithium metal was first produced in quantity in 1923 in Germany.

Uses

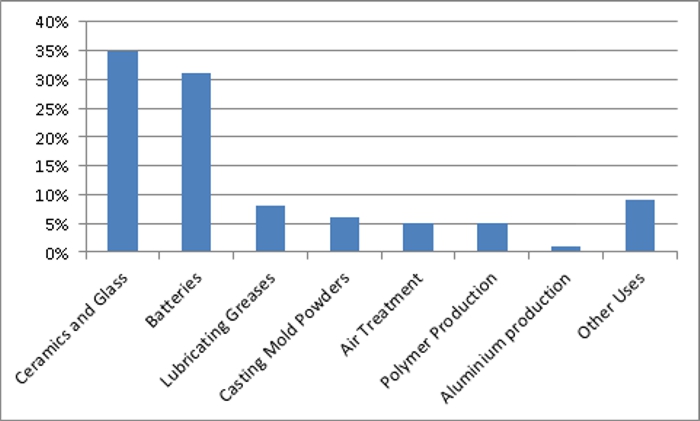

The use of lithium and its compounds is shown in the chart below. The two main uses are in glass and batteries.

It is used as lithium oxide (Li2O) or spodumene (a common ore of lithium – LiAl(SiO3)2) in glass making. The addition of lithium makes glass easier and cheaper to manufacture. It also makes the glass substantially lighter.

Lithium metal is used as an anode in single use batteries such as button cells, like the CR2032.

Re-chargeable lithium ion batteries (electric cars, storage etc.), use lithium as the anode in various compounds, such as lithium cobalt oxide. It is also used as the electrolyte, in the form of organic carbonates that contain complexes of lithium ions. The cathode is typically graphite.

The lithium compounds sold to battery manufacturers and other end users include high purity lithium carbonate, lithium chloride and lithium hydroxide.

End uses of lithium and its compounds

Substitutes & Recycling

Lithium is not likely to be displaced in glass manufacturing in the near term. Sodium, potassium and zinc, to name a few, may be incorporated into the mix. While this may reduce the future dominance of lithium, it will not eliminate its use.

There are a number of challengers to lithium in the battery space. However it could be ten years or more before lithium batteries face serious competition from alternate technologies.

However, graphite cathodes are at much greater risk as graphite is a severe limitation to Lithium-ion battery performance.

Recycling of lithium-ion batteries is in its infancy. The batteries contain toxic materials, and recycling is expensive. This will be one of the biggest issues the industry will face in the future. In fact the cost of an electric vehicle would be much higher if the purchase price included the cost of disposal and recycling.

Supply and Demand

Global production in 2014 is estimated by the United States Geological Survey (“USGS”) to have been 36,000 tonnes of contained lithium. The largest producers were Chile, Australia and China. It is sourced from either subsurface brines or hard rock pegmatite mines.

Demand is increasing by around 5% per annum, mostly for use in batteries. Supply is matching demand, with increased production in recent years from China, Argentina, Chile and Australia.

According to the USGS, the world has about 13.5Mt of contained lithium in reserves, and resources of 40Mt. To put this in perspective, that is equivalent to 1,400 years of supply at the current rate of consumption.

If it all occurred as spodumene in a typical pegmatite deposit with a lithium grade of 1.2%, it would equate to a deposit of 4.4 billion tonnes.

Prices

The average price of battery grade lithium carbonate sold in the US reached a peak price of USD6,800 per tonne in 2013. It declined slightly to USD6,600 in 2014, largely as a result of increased supply effectively balancing increased demand. However, prices do vary depending upon grade and other factors.

Some Australian Lithium Producers, Developers and Explorers

Talison Lithium Limited (unlisted). Lithium pegmatite mine in Western Australia (“WA”).

Altura Mining Limited (ASX: AJM, market cap $36M). Lithium pegmatite resource in WA

Pilbara Minerals Limited (ASX:PLS, market cap $200M). Lithium pegmatite resource in WA.

Galaxy Resources Limited (ASX:GXY, market cap $89M). Lithium brine resource in Argentina, lithium pegmatite resource and plant in Australia, lithium pegmatite project in Canada.

Neometals Limited (ASX:NMT, market cap $74M). Lithium pegmatite resource in WA.

Lithium Australia NL (ASX:LIT, market cap $13M). Lithium-bearing mica resource in Poland.

Conclusion

Although the outlook for lithium demand looks strong, the world is not short of lithium and unexplored lithium-bearing pegmatites are widespread. Further, increasing demand has so far been met by increasing supply.

This has been a frothy market since early 2015 and most players in the lithium space have seen substantial share price appreciation. Nonetheless a strong project, experienced management and a strong offtake partner should see one or more new Australian producers over the next few years.