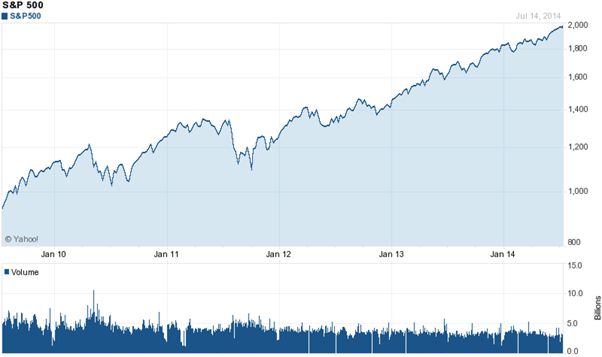

So who’s buying the S&P500

Well, the Buy The F**king Dip (“BTFD”) crowd is still active and have recently been joined by the Buy The F**king All Time High crew (“BTFATH”). Now we all know that the Zero Interest Rate Policy and Quantitative Easing have left yield seekers few alternatives and so stocks grind higher. But really, almost doubling over five years during what are still recessionary conditions?

Courtesy Yahoo.com

The primary drivers of the rise are companies within the index itself. Companies continue to buy back their own stock, usually with borrowed money. Thus, while earnings may not improve, earnings per share does improve. This has a number of benefits, not least improved bonuses.

On the same subject, creative accounting is also helping companies show improved earnings. Wells Fargo, the largest mortgage originator in the world, reported a 58% decline in mortgages written for the last quarter, compared with the prior year. But the company reduced its provision for future losses (by USD435 million) to allow earnings to look just fine. Incidentally, this drop in mortgages does not suggest a housing recovery will be sustained.

So we have something of a feedback loop. Less shares available and inflated earnings justifying “low” Price Earnings ratios and “high” Earnings Per Share. Thus justifying the BTFATH.

Some more on debt: corporate debt is at an all-time high. In addition to buy backs it is also being used to finance dividends and M&A activity, both of which also put upward pressure on the indexes. This is not a sign of robust corporate health; none of these activities are productive.

Courtesy SG Cross Asset Research

Most corporate debt is junk bond status, but listen to this replay. The debt is being securitised and sliced up and then the investor is being miraculously presented with AAA corporate debt. Another form of Collateralised Debt Obligation, no doubt with a serve of Credit Default Swaps on the side. Finally, companies are even using secured bank loans for share buy backs and dividend payments, unbelievable.

But it is not only stocks of course, art is on a bubble-like trajectory, even for still living artists, who are no doubt painting like crazy. Classic cars, real estate, you name it, it is expensive and frothy.

It is difficult to see how this will end well and there are troubling signs; trading volume is down and most stocks are below 52 week highs. But then Goldman Sachs recently lifted its S&P 500 target from 1900 to 2050, so perhaps there is nothing to see here after all.

-oo0oo-