Markets are Expensive Now – Where to Post-Election

A useful snapshot of market value is the trailing price to earnings ratio (P/E). some look at forward P/E’s, but this includes future earnings estimates which may be in error. However, a problem with the standard 12 month trailing P/E is that abrupt market moves can cause a disconnect between price and earnings.

Robert Schiller, Nobel laureate, progressing early work by Benjamin Graham and David Dodd, developed the “Cyclically Adjusted Price Earnings Ratio, CAPE, whereby earnings were averaged over 10 years. Also known as P/E10.

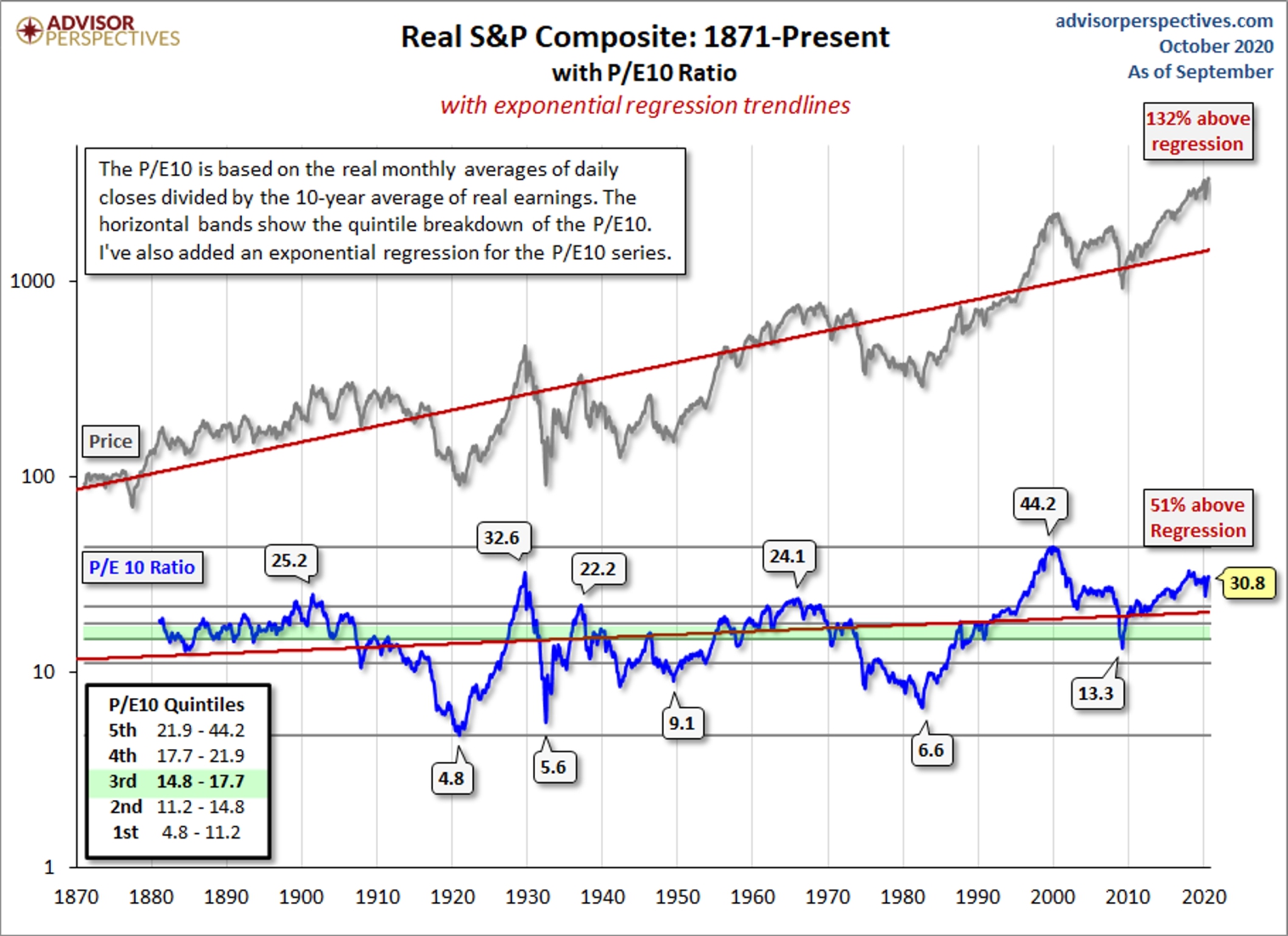

The excellent chart below is courtesy of Advisor Perspectives. It shows both the S&P Composite and the P/E10. In both cases the S&P looks expensive in relation to the regression trendlines.

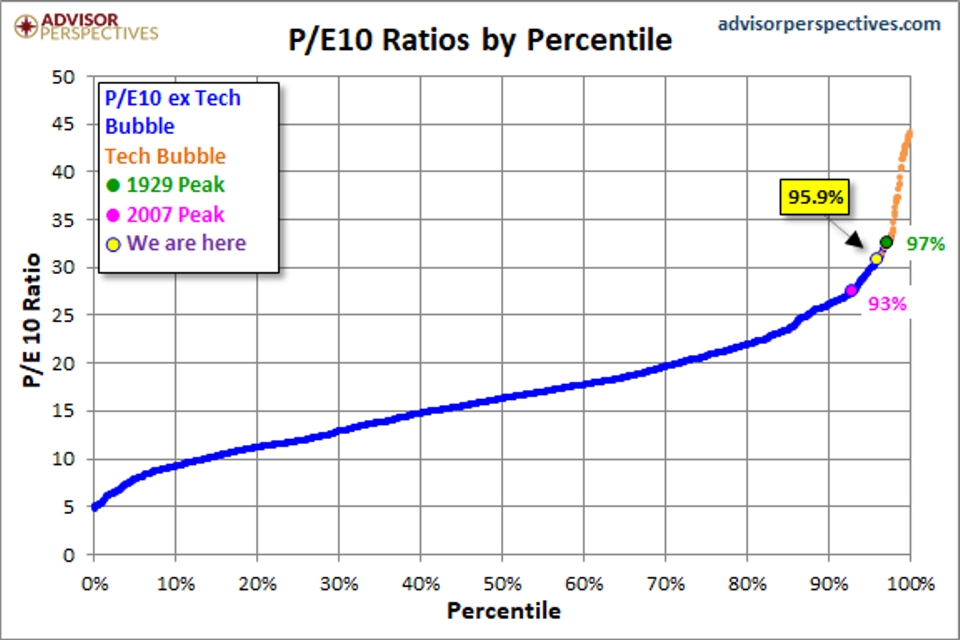

Finally, here is a very interesting chart that puts today’s ratio in stark perspective with past crashes.

So unless earnings grow substantially the future looks a little glum. However, one of the main factors that has sustained the market of late is government largesse – miniscule interest rates and government handouts. The market is predicting a Biden win, and if the Democrats also take the Senate, more handouts are expected. However the equity options market is split, with 45% expecting a drop and 54% a gain. Will be an interesting few days.