Large Financial Sectors are a drag on Growth and Productivity

Two weeks ago I wrote that Australia was “overbanked”, which poses a risk to the economy. Last week the Bank for International Settlement (“BIS”) released a research report entitled “Why does Financial Sector Growth Crowd out real Economic Growth?” This report references an earlier research paper “Reassessing the Impact of Finance on Growth”. Details and links to both papers are listed below.

In brief, the reports conclude that a booming financial sector reduces productivity and real economic growth. Even worse, a booming financial sector harms the real engines of economic growth, particularly those businesses that have large R&D departments.

A reason for this effect is that the financial sector prefers to lend against collateral rather than business growth. Most collateral is housing, which is not a productive investment. This paper could be describing present-day Australia, where residential real estate is the only game in town.

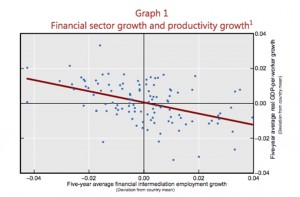

The chart below (from the 2015 report) shows productivity growth on the vertical axis and employment growth of the financial sector on the horizontal axis. There is a clear, negative correlation between the two.

There are other negatives to an expanding financial sector. For example, it tends to attract intelligent, skilled workers that would otherwise be contributing to productivity growth. I recommend reading both papers, as this is a subject too important to ignore.

SG Cecchetti & E Kharroubi (July 2012) Reassessing the impact of finance on growth (BIS)

SG Cecchetti & E Kharroubi (February 2015) Why does financial sector growth crowd out real economic growth? (BIS)

————————————

Also last week Brad DeLong of Washington Centre for Equitable Growth summarized a paper by Thomas Philippon of NYU titled “Finance vs Walmart: Why are Financial Services so Expensive?” Brad includes a link to the full paper. It covers similar ground to those above and is also worth the read. The paper includes a great quote by Winston Churchill:

“I would rather see Finance less proud and Industry more content.”

Winston Churchill, 1925

Conclusion

Large and growing financial sectors are a drag on economic growth and on productivity. However, it is difficult to see large financial sectors such as that in Australia’s being wound back anytime soon.