Inflation or Deflation Ahead?

When the money printing and handouts commenced with the Covid-19 lockdown, there were immediate fears of inflation or even hyperinflation. The thought was that with so much more money chasing the same goods, prices would inevitably rise. While some items, such as some food, did show minor rises, in the main prices have not risen.

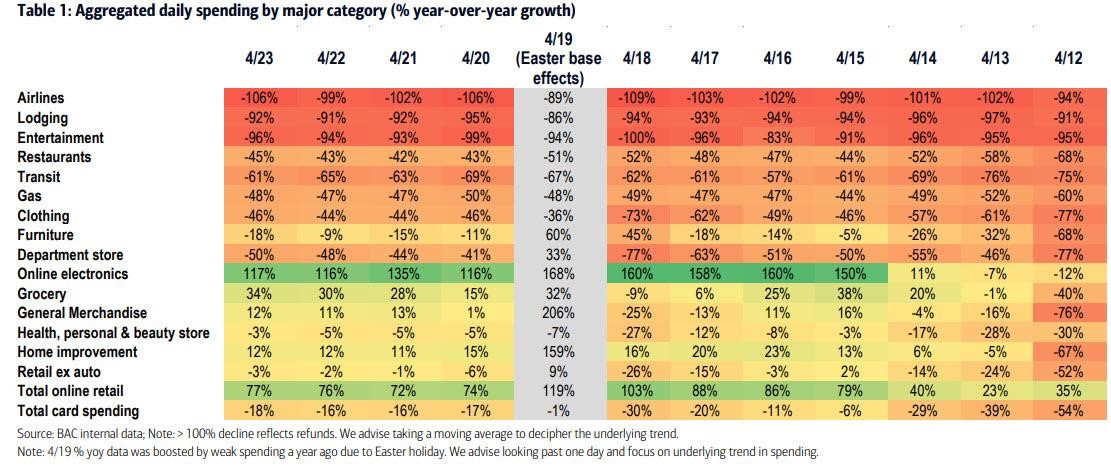

The table below from Bank of America (NYSE: BAC) is a great snapshot of US consumer activity. Among the larger sectors, only online retail and groceries showed growth during the second part of April. This does not look like an inflationary environment.

Elsewhere, the news also points to deflation. The new and used car markets are a disaster worldwide. For example, at the height of coronavirus crisis in China car sales fell by 96%. They have since recovered but are still only 66% of normal levels. In Australia, new car sales in April fell by 49%, after falling 16% in March, and dealers are letting staff go and putting others on reduced rosters.

Below are a couple of charts showing the disaster in the US wholesale vehicle market. Both charts are from a JD Power report.

In summary, with continued lockdown and increasing unemployment it is difficult to see how inflation could get a hold. So, I think deflation, perhaps for the duration of this crisis.