A Great Chart on S&P 500 Futures Liquidity

S & P 500 futures contracts were introduced by the Chicago Mercantile Exchange(“CME”) in 1982. The contract is based upon the 500 companies that comprise the S&P 500.

The contract unit is USD250 times the value of the S&P 500. Thus 250 x 2091 (last traded S&P 500 value) is USD522,750 per contract. There are other futures contracts, such as the E–mini, also a CME contract, one tenth the size of its big brother.

S&P 500 futures contracts are settled in cash. An investor has a long or short position that is marked to market and profits or losses are paid for the day.

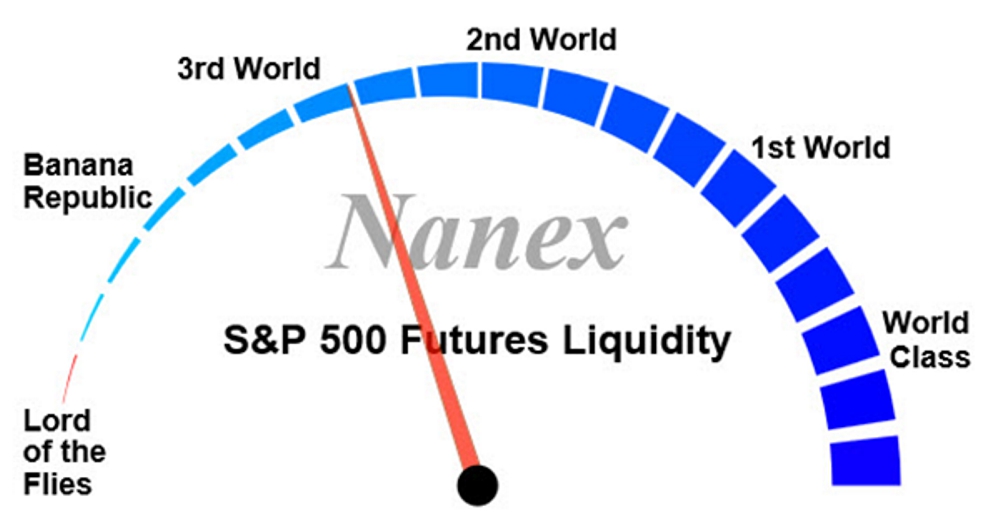

S&P futures are among the most liquid of any traded capital asset. Consequently, liquidity can be viewed as a measure of economic health. Nanex, LLC has one of the best charts I have seen on liquidity. It is a little tongue in cheek but worth checking from time to time.

This not a healthy picture but it is only one aspect of the US/global economy. Update the chart here.

NOTE

This article is a snapshot of index-based futures contracts. There are many others and also derivatives, such as options.