Elements at Risk of Supply: What are They and Who’s Got Them

Elements at risk of supply (often referred to as strategic minerals/metals) have made headlines over the past couple of years. This has been a direct result of China re-imposing export quotas on those elements where it is the world’s leading supplier.

One of the biggest price bubbles due to supply restriction was with rare earth elements (“REE’s”). However rare earths are not rare at all, read more here, but a lack of exploration and development around the world led to China becoming the dominant producer.

Antimony, on the other hand, is rare, read more here, China absolutely dominates supply and it will take some time for other countries to discover and develop alternative supplies.

In 2011, for the first time, the British Geological Survey published a “supply risk index”. The index ranks elements (or element groups) in order of the most vulnerable to supply disruption. The index includes a number of factors such as scarcity, location and concentration of production, recycling and substitution. These factors are then weighted and summed.

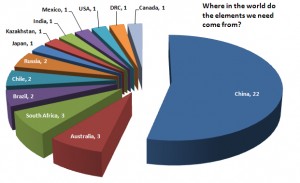

The chart below show the number of elements for which each country is the dominant supplier.

Source: BGS World Mineral Statistics.

It is sobering to note the dominance of China. China is the dominant supplier for over half of all elements. Further, it is the leading producer of the five elements with very high supply risk. They are, in order; rare earth elements (Symbol: REE), tungsten (W), antimony (Sb), bismuth (Bi) and molybdenum (Mo).

The next five elements with high supply risk, and their leading producers, are: strontium (Sr), China; mercury (Hg), China; barium (Ba), China; carbon as graphite (C), China; and beryllium (Be), USA.

The five elements with the lowest supply risk, and their leading producers, are: copper (Cu), Chile; zinc (Zn), China; aluminium (Al), Australia; titanium (Ti), Canada; and iron (Fe), China.

Australia is the world’s leading producer of lithium (Li), zirconium (Zr) and aluminium (Al), all ranked as modest to low risk. South Africa is a high risk supplier of platinum group elements (PGE), and a moderate risk supplier of vanadium (V) and chromium (Cr).

Last Word

Supply risk is a very useful comparative for investors in the junior resource sector, as demonstrated by previous strong runs in rare earth elements and graphite.

However some factors will almost certainly limit exploration and development of some of the top contenders. For example, the east coast of Australia hosts a number of rather good antimony prospects. However environmental resistance has been rather vociferous and may make even exploration drilling difficult.or the investor: it would be well worth researching companies that may provide exposure to those elements with high supply risk.

There’s a lot of noise in this space, but here are some that may be worth looking at:

Tungsten Mining NL ASX: TGN tungsten

Auzex Exploration Limited PRE-IPO tungsten, bismuth,

molybdenum

Torque Mining Limited IPO tungsten, bismuth

Artemis Resources Limited ASX: ARV antimony

Northwest Resources Limited ASX: NWR antimony

Mandalay Resources Corporation TSX: MND antimony (in Australia)

Coppermoly Limited ASX: COY molybdenum

Dart Mining NL ASX:DTM molybdenum

Ivanhoe Australia Limited ASX: IVA molybdenum

Finally; price volatility is high in this space, investor beware.