Are The Bears Calling

This article is not a prediction for a bear market. It is a collation of relevant information that may help the reader with investment decisions.

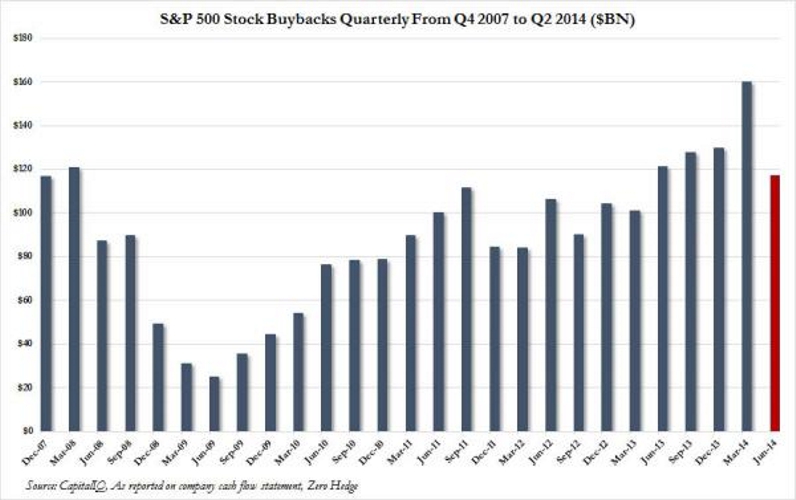

Plummeting Share Buyback Volume

In July I discussed how the main buyers of the S & P 500 were companies within the index itself. Companies have been buying their own shares back, usually by way of debt. See here and here for some interesting charts and more detail.

It appears the “buyback party” may be coming to an end, judging by the substantial drop in buybacks during the June quarter. However this is only one quarter of data, so it is too early to call a trend. But if it is a trend, then the S & P 500 is looking fragile.

Insiders are Selling

While US companies are buying their own stock, their executives are selling. Bloomberg and The Washington Service say 7,181 insiders bought their own stock but 23,323 sold, in the year to mid-September. This infers shares are fully valued and leads into the following signal.

American CEOs are Negative

American CEOs of the Business Roundtable are gloomy about future prospects. They expect sales and employment to stagnate and capital expenditure to decline.

Billionaires are Negative

Many wealthy, successful investors such as Sam Zell, George Soros, Carl Icahn and Jeremy Grantham, are calling for a correction, possibly severe.

Who is Left to Buy

There are few Bears left, they have all joined the Bulls. This is starkly shown in the chart below. It raises the question, where is the next round of buying coming from?

Chart Courtesy of Charles Hugh Smith

The Biggest Float

The Alibaba float also seems to indicate a frothy market. At Monday’s close its Market Cap was USD221 billion. This is a company with no assets to speak of, no monopoly and an obscure earnings stream. Further, it operates primarily in China, which is in the midst of an economic slowdown. Interesting that the IPO was Wall Street, not Shanghai.

Illustration from “Ali Baba and the Forty Thieves”, in the ” Arabian Nights” book of the late Nineteenth Century

Many Stocks are Bearish

Almost half of Russell 2000 (US small caps) and NASDAQ stocks are in bear market territory. That is, they are 20% or more off their peak. This narrowing of market breadth is not a bullish sign.

Don’t get Caught

Is there any World Growth

World growth remains anaemic and, in fact, many countries are effectively in recession. Growth has slowed in China and the government is reluctant to continue ongoing stimulation by way of “evermore” debt.

What About Australia

Here in Australia, declining commodity prices, iron ore and coal in particular, are causing a rapidly shrinking resources sector. The only other “pillars” of the Australian economy are banks and housing. We have the most expensive housing in the world, by any measure. And it is this very housing market that comprises the majority of banks’ assets, and has generated much of their profit. Risky times indeed.

Conclusion

It is difficult to see what will sustain a continuation of this aging bull market. It is doubtful that more ZIRP (“zero interest rate policy”) and QE (“quantitative easing”) will be enough to keep the party going. Caution is recommended, there could well be a hangover just around the corner.