The Australian Stock Market is Overexposed to Banks

There are five large listed companies in Australia. Four of them are banks and the fifth is BHP, one of the world’s largest mining companies. The financial sector amounts to around half of Australian stock market capitalisation. The vast majority of the sector is comprised of banks and “diversified” banks. The remainder is insurance and real estate.

Before going further we need to understand just how small Australia is. In terms of population, Australia is the same size as Shanghai and slightly larger than Beijing; about the same as NY State; and three times larger than London.

In terms of GDP Australia comes in at number twelve (IMF 2013). Australia’s GDP was USD1.5T, compared with the US at 16.7T and China at 9.5T.

Moving on.

The market map below shows the relative market capitalisation of various sectors. The dominance of the financial sector is astounding. I doubt it is replicated in any other developed economy.

Courtesy Commsec Securities and IRESS (Click for full size)

Here in Australia, we have four leviathan banks: “the big four”. They are, in order of size; Commonwealth Bank of Australia (ASX: CBA; MCap AUD150B); Westpac Banking Corporation (ASX: WBC; MCap 115B); ANZ Banking Group (ASX: ANZ; MCap 97B); and National Australia Bank (ASX: NAB; MCap 90B).

These four banks dominate the market and yet their primary business is consumer loans and residential mortgages. Australia’s residential real estate market is already one of the top three most overvalued in the world, competing with Canada and Norway on several metrics.

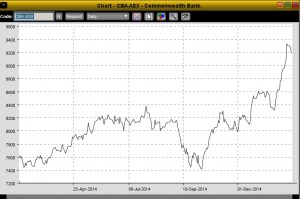

Look at the CBA share price chart below. It reflects the assumption that Australians will continue to borrow evermore for overpriced real estate. The recent, steep price increase was a result of buy recommendations from various financial organisations, based upon yield rather than future earnings potential.

Courtesy Commsec Securities and IRESS.

Australian export income has collapsed, as has manufacturing. And imports are much more expensive, due to the decline of the Australian dollar. But our Reserve Bank takes comfort in the strength of our residential construction sector. So our economy is going to consist of building houses and apartments for which we will pay ever higher prices?

And Australian business confidence is low. Very low. In fact, the CEO of the Commonwealth Bank warned yesterday that this is a “significant economic threat”.

With all this as a backdrop, the truly productive parts of the economy (Materials, Energy, Health Care, Industrials, IT and Utilities) are proportionately small, and shrinking. Not helped by Australia’s appallingly low productivity.

Conclusion

The Australian stock market is exposed to both internal and external shocks. Downside risk is considerable.

I am reminded of Donald Horne’s 1964 book about Australia; “The Lucky Country”. He used the word “Lucky” satirically.

Here’s a quote:

“Australia is a lucky country run mainly by second rate people who share its luck. It lives on other people’s ideas, and, although its ordinary people are adaptable, most of its leaders (in all fields) so lack curiosity about the events that surround them that they are often taken by surprise.”

The proof: Australia ran deficits through most of the, now departed, resource boom. WTF – and what’s next?