Iron Ore Price

A new paradigm, reversion to mean, or something in between

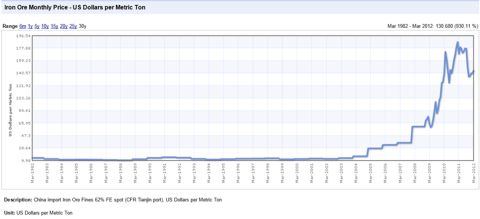

The iron ore price is something of a proxy for the price of other metals. Exhibit One below1 shows the iron ore price (China Import fines 62% Fe) in USD since 1982. The exponential increase in price from 2008 to 2011 is generally thought to be due to China’s response to the GFC.

That response has been unprecedented spending on infrastructure such as residential and office buildings, roads, railways and indeed entire cities. This has led to China consuming far more iron ore and cement per capita than any country ever has before. It cannot be sustained: we all know about the notorious Chinese ghost cities, universities and highways to nowhere.

Exhibit One

In terms of consumption, this is not a good look for the iron ore price going forward. Nor is the future of supply.

China is by far the largest producer of iron ore 2 and is planning to increase capacity through development of large scale projects around the world, notably in West Africa. The world’s biggest suppliers to the seaborne trade are also planning massive expansion programs. There is likewise a host of second tier, third tier (and so on and on) companies with apparently sensational projects ripe for development. Tears are guaranteed. Perhaps unless the main investor is China?

Now, “reversion to the mean” is a theory that suggest prices, investments returns, or some such, ultimately revert back to a mean or average value. While it may have value in some cases (say the long term price/earnings ratio of shares), it is often useless, as the parameters used to define it are chosen to suit the view of the proponent.

In a similar vein the proponents of a “new paradigm” would tell us that things are different this time. Regularly, this has not proven to be so. Most markets are governed by human emotion, not fact or logic. Maybe things are different this time, but we have all seen exponential madness in recent years.

Final Word

The days of iron ore prices of USD15 – 30 per tonne are behind us, well behind. But then again, today’s price of USD140/tonne looks unsustainable. It is most likely that the iron ore price will decline, but not below a level that ensures the big seaborne traders stay profitable – “something in between”.

So…going forward…you want production costs of less than around USD40-50/tonne, and forget anything with ultrahigh capital costs for development.

oo000—000oo

1 This chart is courtesy of www.indexmundi.com. I highly recommend this site. It is the brainchild of Miguel Barrientos and provides worldwide statistics in a really useful, graphical manner.

2 In 2010, China produced 1,070 million tonnes of iron ore, Australia 433, Brazil 370, India 230, Russia 101, Ukraine 78, South Africa 59, Iran 28, Canada 37, USA 50.

Source: United States Geological Survey.