The Real Gold and Silver Prices

In economics a real value is a value that has been adjusted for inflation, whereas a nominal value has not been adjusted. Gold and silver are quoted in USD, which is considered real as the USD is adjusted by the consumer price indices (CPI) produced by the US Bureau of Labour Statistics.

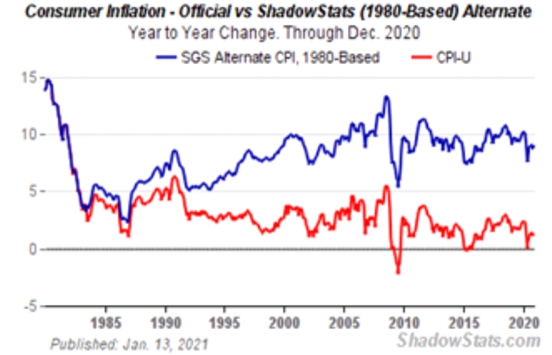

But the CPI is regularly adjusted to minimise inflation and is thus considered meaningless by many. Of course, the US is not the only country to make such adjustments. John Williams at ShadowStats has calculated inflation using the 1980 methodology, as below. The difference is staggering.

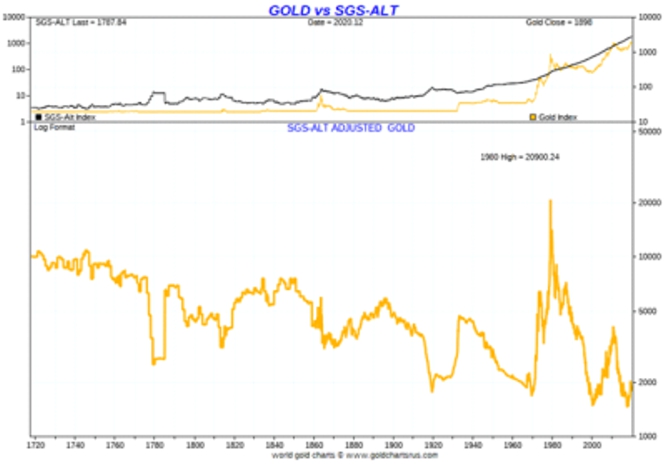

Now GOLD CHARTS ‘R’ US has used the ShadowStats alternate CPI to calculate the gold and silver prices back to 1720, as shown below. The current gold price is USD1839/oz, that compares with the 1980 high of USD20,900/oz. In fact, the current price is near its all time low for the period. It is a similar story with silver.

At some stage one would expect inflation to take centre stage, particularly with the amount of worldwide money printing. Many commentators are bullish on gold and silver, typically with modest predictions of an increase in price to USD2,000/oz or so. However, in this article Jim Rikards suggests USD14,000/oz or higher is possible as the debt crisis unfolds.

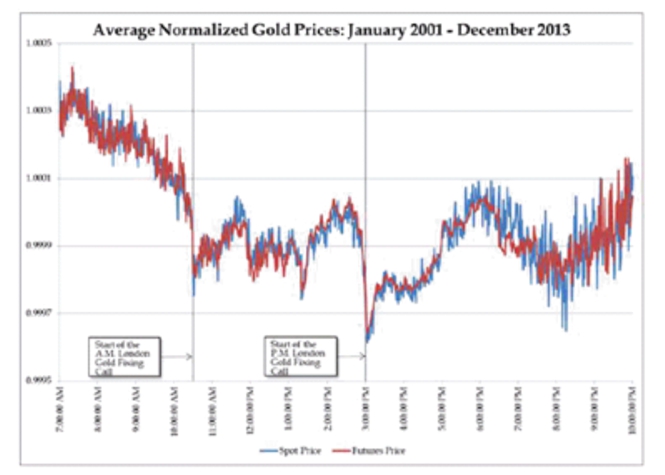

Finally, the chart below, also from GOLD CHARTS ‘R’ US, shows price falls at the AM and PM London gold fix. And this is averaged over 12 years. This has resulted in a number of class action complaints. Anyway, something else to take account of when predicting the future gold price.