The Zinc Market

Zinc is the fourth most produced metal behind iron, aluminium and copper. About 75% is used as a coating (galvanising) to protect iron and steel from corrosion. It is also used in brass and bronze, as a casting alloy and in other industries such as chemicals and agriculture.

All living organisms require zinc and in humans it is necessary for correct functioning of the immune system, digestion, reproduction, vision, taste and smell. Zinc deficiency is one of the leading causes of sickness and disease in developing countries.

Supply

Global zinc production was 13.5Mt in 2019. Fitch Solutions estimated that there was a deficit of 189kt in 2019 with an expected surplus of 71kt in 2020. BMO estimates a surplus of 335kt in 2020. Fitch estimate an annual growth of 2.1% through to 2028. Sverdrup and Ragnarsdottir estimate peak production of 20Mt/y in 2030. Calvo et. al. estimate peak production of 17Mt/y in 2016.

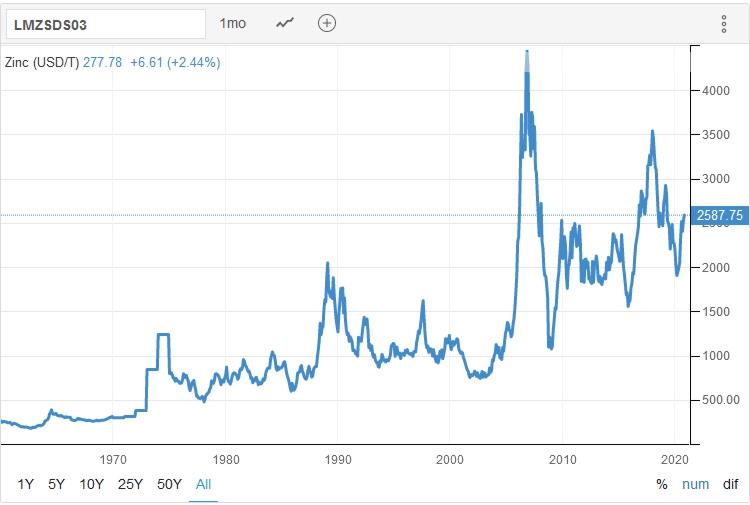

Estimates are highly variable but the consensus is that supply will continue to increase. This is largely because the strong zinc price has led to increased production rates at existing mines, re-openings of mothballed mines and accelerated development of projects in the pipeline.

Demand

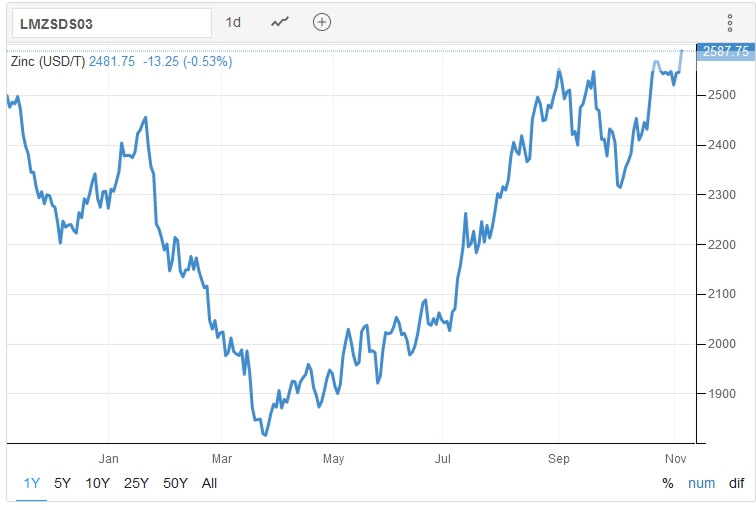

Demand is primarily driven by the construction and auto markets, both of which have slowed in 2020 post-coronavirus. However, stimulation (money printing) in many economies is seeing a pickup in manufacturing, particularly in China. Stronger demand is supported by LME futures. The current price is USD2547.5/t, USD2557/t 3 months out and USD2593.5 in December 2021.

Zinc Trading

In common with most metals, the majority of zinc is traded privately between buyers and sellers. However, the London Metals Exchange, among others, offers a forum for metals trading by way of standardized futures and options contracts. The LME also holds stocks of various zinc brands in approved warehouses around the world.

There is a fallacy that London Metals Exchange (“LME”) stocks, and that of other exchanges, are somehow indicative of supply demand balance. They are not, they are primarily a function of financing and warehouse competition. The primary purposes of the LME are price discovery, hedging and actual metal delivery.

Treatment Charges

When concentrate is in short supply charges fall as smelters attempt to attract sufficient concentrate. Lower treatment charges have a proportionately greater effect than higher prices, it is estimated that a USD50/tonne fall in treatment charges is equivalent to a USD100/tonne increase in the zinc price.

A consequence of the tightness of supply is that smelters and related parties provide finance for mine development, or take equity positions, in return for concentrate off-take agreements.

A supply surplus will not only see rising treatment charges but smelters may also refuse to take lesser quality concentrates.

Conclusion

The future zinc price will be determined by global economic growth. Supply growth seems a given for the next decade, so any decline in economic growth will put downward pressure on zinc, along with some other commodities.

Charts courtesy Trading Economics