ASX Pot Stocks

Most cannabis stocks burst onto the scene in 2018, particularly in Canada. We lagged a little in Australia but did catch up with spectacular gains made by a number of pot stocks. The hype was based upon the belief that pot was going to be legalised, for both medicinal and recreational use, throughout the Western world.

California was used as an example; cannabis was soon to be legalised and sales were expected to go through the roof. However, with huge taxes, 40% or so of the retail sale price, the “legal” market has been sluggish. In contrast the black market has exploded.

All uses of cannabis are legal in Canada, but of course with no barriers to entry, the market is, or soon will be, saturated. And do not presume the black market will disappear, anywhere.

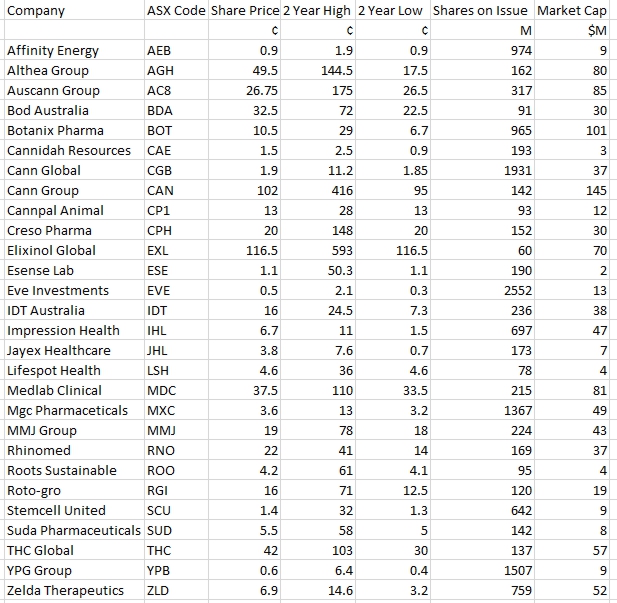

As the weak fundamentals of the cannabis market sunk in, so did share prices. I have listed below the 28 main ASX-listed pot stocks. On average, these stocks are 31% of their two year high. The best performer is IDT which is 65% of its two year high, the worst is ROO at 7%.

There is a school of thought that buying opportunities now abound as these stocks are so far off their highs. However, be mindful that most of these stocks have no, or very little, revenue and profits are really just a pipedream. In my opinion, this is a sector to avoid. Caveat Emptor.