A Great Article by the IMF on Global Financial Interconnectedness

This 2010 IMF article remains pertinent today. Countries are financially interconnected through sovereign assets and liabilities, financial institutions and corporations. This of course leads to a very complicated risk profile where failure in one institution, such as Lehman Brothers in 2008, can have multiple unforeseen consequences.

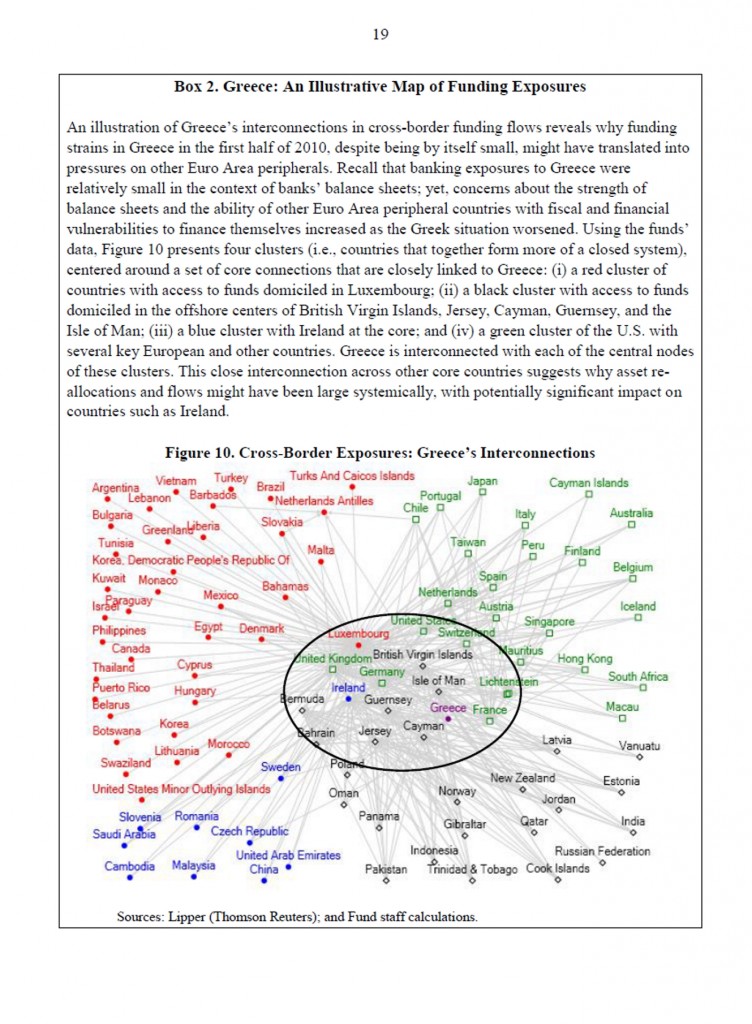

This article is an excellent attempt to explain the interconnectedness and the associated risk between various entities. The chart below shows how various countries were interconnected with Greece in 2010. The situation is unlikely to be much different today. It also shows how simplistic much of media commentary on Greece really is.

I highly recommend you read the article – IMF – Financial Interconnectedness