The Surprising Resilience of the Junior Resource Sector

For most of my professional life I have worked as a director of junior exploration/mining companies. The most difficult task, as director of a junior, is raising capital during a resource sector bear market. Brokers and investors have negligible interest in listening to your story. It is even worse if you have a low Market Cap. Each discounted raising thus eviscerates existing, loyal shareholders.

However, the sector is nothing if not creative and resilient. A common solution is a change of direction. Either into a commodity “du jour”, or into another sector all together. During the 1990’s it was the tech sector and today biotechnology and related fields are proving popular.

Richard Schodde, of Minex Consulting Pty Ltd, has prepared a most interesting presentation on the sector; “Uncovering exploration trends and the future: Where’s exploration going”. Read the full report here. The following charts are from his presentation.

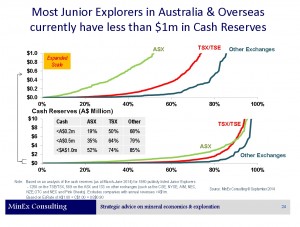

The chart below shows the parlous cash position of the sector as at June 2014. Note that over half of ASX-listed juniors had less than $1M in cash. For many, this means it is difficult to keep the doors open, let alone contemplate any exploration.

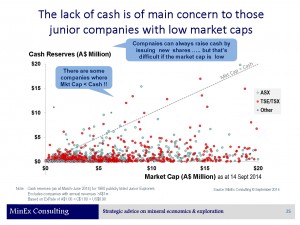

The next chart plots Market Cap against Cash. Market Cap is important as it is relatively easy to raise cash when it is high. There is a huge cluster of companies around $2M market cap, with very little cash. These companies will have great difficulty raising capital without re-inventing themselves.

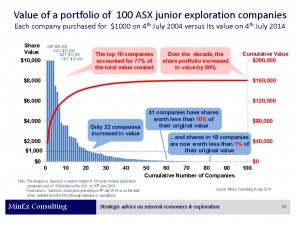

The next chart from Richard shows the performance of 100 juniors he selected. He compared their position in June 2004 with their position ten years later in June 2014. In my opinion, this chart suggests that risk in the sector is less than we often think.

While most companies are now near worthless, 22% did make their shareholders money. Most people I speak to about risk at this end of the market would think that number would be much smaller, perhaps 5% or less. If the investor had selected good management and superior projects the success rate would be even higher.

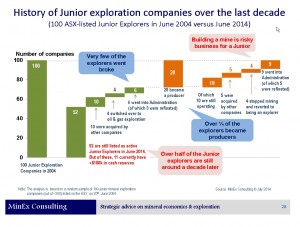

Finally, the last chart is cause for optimism about the sector. The failure rate is lower that you might expect. Most failures happen when explorers attempt the transition to mining.

Conclusion

While the sector is in a bear market, it would be worth researching opportunities for future investment. The most important factors are strong management and reasonable cash reserves. If cash is below, say, $2M, there is a high risk of substantial dilution at the next raising. Advanced projects are preferable, with at least a reasonable resource that can be increased and developed under improved market conditions.