Exter’s Pyramid and Gold

John Exter (1910 to 2006) was a highly regarded American economist. He spent the early part of his career, until 1959, on the Board of Governors of the US Federal Reserve. He is perhaps best remembered for creating “Exter’s Pyramid” in the 1970’s.

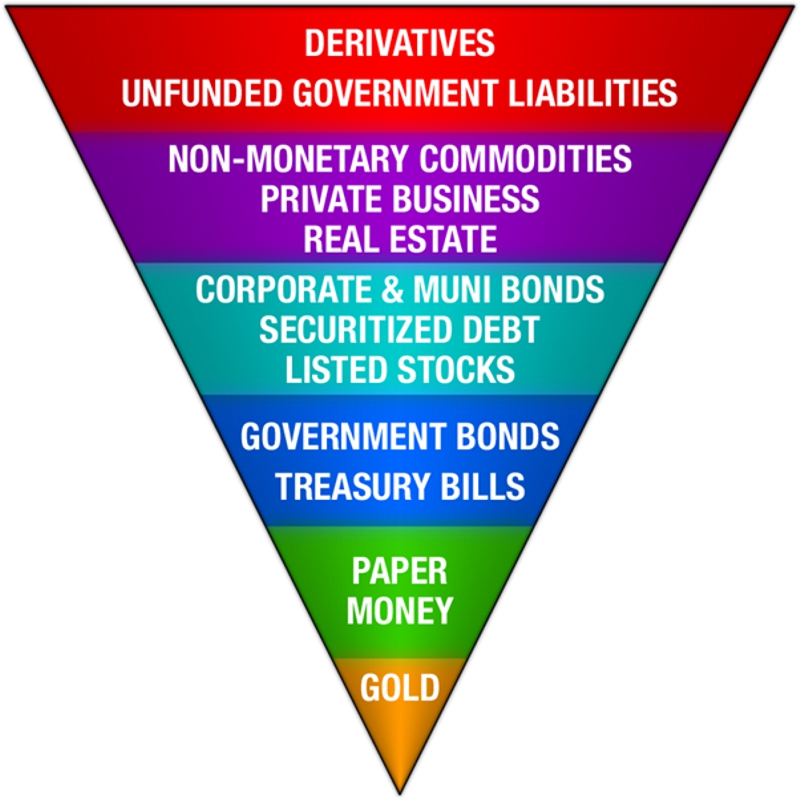

Exter’s Pyramid below classifies asset classes in terms of risk and size. At the time he created it, the most risky asset class was Third World debt. It has been “modernised” to reflect the huge derivatives markets and all the debt issued by Central Banks.

Exter’s Pyramid

Many are predicting that the world is approaching another financial crisis. Should this happen, you would expect a rush from riskier assets to cash and gold. Of course this might be easier said than done. It is hard to imagine many buyers for government debt, with everyone rushing for the exits at the same time.

At current prices the gold market is minuscule, as shown in the pyramid. This is why many believe that the gold price could increase exponentially during the next financial crisis.

It appears some countries are hedging against a future crisis. China and Russia have been large buyers of gold over the past few years. Germany and others have unsuccessfully tried to repatriate their gold from the US.

On November 30 the Swiss will hold a referendum on a “gold initiative”. The initiative covers three things: the Swiss National Bank (“SNB”) must hold at least 20% of its assets in gold; the SNB cannot sell any gold; all gold must be stored in Switzerland. Naturally, as a Central Bank, the SNB is against having its wings clipped.

There is an argument that if interest rates rise, the gold price will fall. Perhaps. The 1970’s were a period of high interest rates. A period when the gold price increased about 20 times.

Conclusion

Investors should hold at least some gold (and silver) as a hedge against the next financial crisis. Everything else, other than actual cash, will underperform, including real estate.