US Shale Oil & Gas: A Revolution?

In an article in the Sydney Morning Herald a few days ago it was claimed that there is an “energy revolution” underway in the US. The upshot was that cheap gas & oil was luring foreign manufacturers to build factories in the US. It would also undercut Australia’s export LNG industry. The article even quotes Shane Oliver, Head of Investment Strategy and Chief Economist at AMP Capital.

It is difficult to see any evidence for these conclusions.

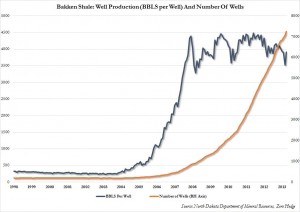

The chart below shows oil production and wells drilled in the Bakken Shale of North Dakota. The “revolution” started 10 years ago and really took off around 2007-08. At that time annual production was around 4,000 barrels of oil per well from around 1,000 wells. Production today is about the same, but from over 7,000 wells. This is because of the very short lifespan of shale wells,compared with conventional plays. So ever more wells are required just to maintain production rates.

It is being repeated across the US, in both oil and gas.

Chart courtesy of North Dakota Department of Mineral Resources and Zero Hedge.

Last week Bloomberg published an excellent article titled “Shakeout Threatens Shale Patch as Frackers go for Broke”. Recommended reading.

The essence of the article is that the industry is unprofitable at current prices. The industry overall is carrying debt of around USD160 billion and is running at a loss.

Last Word

This is an excellent demonstration of energy return, or Energy Return on Energy Invested (“EROEI”). Shale oil and gas production is very expensive, it has a low EROEI. It costs upward of USD10 million to drill and frack a hole and, as the chart above shows, is requiring ever more drill holes to maintain production.

There are only thee outcomes, higher prices, or lower production, or both. Australian LNG exports won’t be meaningfully affected by US production. Qatar and Russia/China are a different proposition.