Peak Oil is in Sight

There is ongoing debate as to whether the oil price collapse (and partial recovery) is supply or demand driven. [Of course there are also conspiracy theories; such as the US and the Saudis ganging up on Russia.]

To me, the price is demand driven. Most of the world’s economies are stagnating, or worse. And most economies are using oil far more efficiently than even a few years ago. See one of the best charts, explaining the relationship between oil demand and price, here.

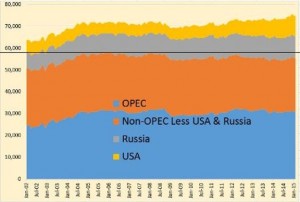

However, the big picture shows that most oil producers are at or past their peak production. The chart below shows that, outside of the US and Russia, most production peaked around 2005.

Chart Courtesy Ron Patterson at OilPrice.com

But, the US and Russia both appear to be at, or near, their peak production.

US

The growth in US production has been primarily from shale oil, while conventional production continues to decline. The shale oil boom (“horizontal drilling and fracking”) is probably less than a year or two from its peak. The decline will be precipitous without substantially higher oil prices. Read more on fracking here , here and here.

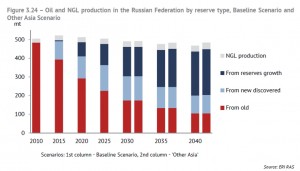

Russia

I refer to a Russian government report “Global and Russian Energy Outlook to 2040”. The chart below is from the 2014 report. It shows that, even with new discoveries and increased reserves from existing fields, the peak is about now. These potential new discoveries may not happen at all, and certainly won’t at current prices.

World

The potential for onshore and shallow water (conventional) discoveries is limited. The majors have spent 10’s of billions over the past 5 years or so, with negligible success. Consequently, they have severely curtailed exploration and development, and bowed to pressure to increase returns to shareholders. Higher dividends and share buybacks, rather than exploration and development.

Deepwater and unconventional exploration requires persistent high prices to be justified. Probably somewhere north of USD100/bbl.

Conclusion

They aren’t making it anymore, and it is mission critical for the world’s economy.

Oil is not going to be replaced by solar and other developments in the near term. It packs a huge bang for the buck; which, today, cannot be matched by “renewables”. For example, electric cars are often really “coal-fired cars” – expensive and polluting.

Finally – risk. Flat, or even negative world economic growth, and thus low oil demand, will negate the above. This is because of the strong correlation between oil consumption (and thus price) and economic growth, as shown in the chart below.

Chart Courtesy Bill Conerly at Forbes

![Oil-Consumption[1]](http://marketcap.com.au/wp-content/uploads/2015/05/Oil-Consumption1-300x135.jpg)