Chinese Steel, Cabbages and Gross Domestic Product

This week China reported quarterly gross domestic product (“GDP”) growth of 7.3%, compared with the third quarter last year. The government target was 7.5% – so well done China. Here in Australia, this result was considered “supportive for commodities” (such as iron ore and coal) and led to a rise in the Australian dollar.

Government statistics worldwide are manipulated. But Chinese statistics are often considered the most pliable. Read more on statistics and lies here.

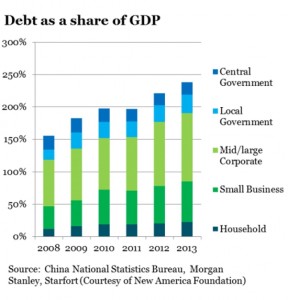

China’s recent growth has been based upon capital expenditure funded by debt. Mostly funded by the private sector, as shown below. The debt has been used to build roads, railways, entire cities, ships and more.

This expenditure shows up immediately in GDP. However, continued GDP growth requires either a positive return on past investment, continued debt-fuelled construction, or a switch to consumer spending. At the moment, you can only tick; “continued debt-fuelled construction”.

China’s steel industry is of particular interest to exporters of iron ore and metallurgical coal. The chart below says it all. According to a recent Bloomberg article, a tonne of Chinese steel is now about the same price as a tonne of cabbage.

China’s steel industry has total annual capacity of 1.1 billion tonnes. The rest of the world only produces about 500 million tonnes every year. Based upon the first half of 2014, China is expected to consume around 750 million tonnes for the year. Much of this is on still more unproductive “roads to nowhere” and “ghost cities”.

There are many measures of Chinese spending on excess capacity and unproductive assets. Here is an example that I like. China has over 1,500 shipyards, compared with 10 in South Korea and 15 in Japan. The world already has too many underutilised ships. Read about global shipping here.

A solution for unsold stocks of steel, ships and the like is, of course, export. There is little worldwide demand for an additional 300 million tonnes or so of steel, or ships. So pricing would have to be predatory, which will inevitably lead to trade wars.

The story is similar for cement, plate glass, and other industrial products.

Conclusion

China’s GDP is not an effective measure of sustainable economic activity. Overcapacity and unproductive construction can continue supporting GDP for some time. But the debt time bomb will keep ticking. There is a large risk that the Chinese economy will act like a house of cards. Remove one support, such as excess capacity, and the effect will be multiplied throughout the economy.

To be fair, China’s dilemma is just a variation on quantitative easing in the US and the mess that is Euroland. None of this government meddling in markets will end well, but could still last for many years yet.

There is no immediate threat to investment in the resource sector, but economic developments in China should be followed closely for signs of economic disruption.