Worth Watching: Ten Potential ASX Copper Developers: 6 Month Update

I first published this article in November 2020. It is largely unchanged, except I have added share price and other data for May 2021. Where relevant, I have updated the text for each company.

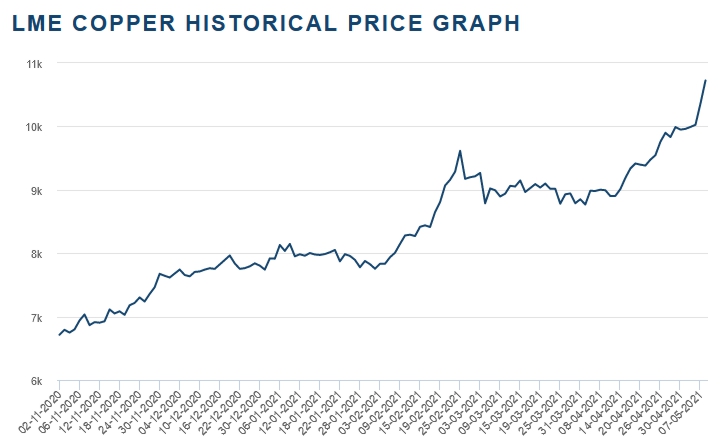

Most have seen very good gains, helped in no small part by the impressive gains in the copper price, as shown below.

ASX listed copper-focussed producers are thin on the ground, really it’s a choice between OZ Minerals Limited (OZL, mcap $5.1B, now $9B) and Sandfire Resources Limited (SFR, mcap $798M, now $1.4B). SFR could be worth a look as the imminent closure of its main mine, DeGrussa, has led to negative market sentiment. However, there is still meaningful profit to come from DeGrussa, the company is cash-rich with a reasonable development pipeline.

There are other copper producers, such as BHP, but leverage to copper is limited.

The list below is not exhaustive and I have almost certainly missed comparable companies. The main issue with companies at this development stage is that the transformation from explorer to developer is very risky. The best factors for de-risking are: a major JV partner; an offtake partner which will also provide funding; project delivery by way of a BOOT (build-operate-own-transfer) delivery process.

Aeon Metals Ltd – AML

| Price (c) | 52 Week Low | 52 Week High | Shares (M) | MCAP (M) |

| 14 | 5.4 | 22.5 | 678 | 95 |

| 7.4 | 7 | 22.5 | 678 | 50 |

| Share Price Change 53% |

The company holds the Walford Creek deposit in NW QLD. It hosts a total resource at Vardy/Marley of 18.4Mt @ 1.05% copper, 0.9% lead, 0.72% zinc, 29g/t silver and 0.14% cobalt and at Amy 5.1Mt @ 1.25% copper, 1.35% lead, 0.63% zinc, 0.14% cobalt.. A PFS is now underway after positive results from a scoping study. Results are expected in the first half of 2022. Parameters were changed for the PFS as the process flowsheet was considered too complex.

Caravel Minerals – CVV

| Price (c) | 52 Week Low | 52 Week High | Shares (M) | MCAP (M) |

| 9.4 | 1.5 | 14 | 253 | 24 |

| 36 | 2.5 | 38 | 348 | 125 |

| Share Price Change 382% |

The Caravel Project in the SW Yilgarn of WA hosts a resource of 662Mt @ 0.28% copper. A scoping study completed in 2019 was generally positive although higher grades at start-up was recommended.

A PFS is expected to be completed and reported by the end of 2021.

Havilah Resources Ltd – HAV

| Price (c) | 52 Week Low | 52 Week High | Shares (M) | MCAP (M) |

| 18.5 | 5.3 | 22.5 | 270 | 50 |

| 22.5 | 8.7 | 25 | 306 | 69 |

| Share Price Change 122% |

The company holds the Kalkaroo project & the smaller Mutooroo project in SA. Kalkaroo has a total sulphide resource of 224Mt @ 0.49% copper and 0.36g/t gold. There is also a small surface oxide gold resource. A PFS was completed in 2019 designed to annually produce 30ktCu and 72kozAu for 13 years with a C1 cost of USD1.67/lb. The company also has two iron ore projects and a tin project.

Hot Chili – HCH

| Price (c) | 52 Week Low | 52 Week High | Shares (M) | MCAP (M) |

| 4.9 | 0.9 | 5.8 | 2439 | 120 |

| 3.5 | 1.4 | 5.8 | 3078 | 108 |

| Share Price Change 71% |

The company holds the Costa Fuega Project in northern Chile. The project hosts two resources. Productora; 273 Mt @ 0.44% copper, 0.09g/t gold and 133ppm moly. Production is expected to recommence at Productora by 2021, in JV with the Chilean government. In 2020 a maiden resource was released for Cortadera; 451Mt @ 0.37% copper, 0.13g/t gold, 0.7g/t silver and 61ppm moly.

KGL Resources – KGL

| Price (c) | 52 Week Low | 52 Week High | Shares (M) | MCAP (M) |

| 32 | 9.3 | 33 | 336 | 107 |

| 75 | 14 | 84.5 | 387 | 288 |

| Share Price Change 234% |

The Jervois Project is located to the east of Alice Springs, NT. It hosts a JORC resource of 21Mt @ 2.03% copper, 31.9g/t silver and 0.29g/t gold, containing 426kt copper in four deposits. The project is quite advanced, with a positive PFS in 2020. The plan is to truck a concentrate to Alice Springs and then rail to Darwin or Adelaide. A FS is underway.

Orion Minerals Ltd – ORN

| Price (c) | 52 Week Low | 52 Week High | Shares (M) | MCAP (M) |

| 3 | 1.1 | 4 | 3397 | 102 |

| 3.9 | 1.3 | 4.5 | 4125 | 161 |

| Share Price Change 130% |

The company holds the Prieska project in South Africa. It hosts a resource of 30.49Mt @ 1.2% copper and 3.7% zinc. A BFS has been completed with robust results. The AISC is USD1.60/lb, and post tax free cash flow is AUD1.6B on capex of AUD413M. Company is at the stage of project finance and seeking a strategic partner. The company expects to be in production by 2024.

Redbank Copper – RCP

| Price (c) | 52 Week Low | 52 Week High | Shares (M) | MCAP (M) |

| 6.7 | 4.8 | 9 | 408 | 27 |

| 11.5 | 4.8 | 15.5 | 516 | 59 |

| Share Price Change 172% |

The Redbank Project is located in the McArthur Basin, NT. It hosts a JORC resource of 6.26Mt @ 1.5% copper for 95Kt of copper metal across several small deposits. The mineralisation is hosted by a series of breccia pipes, one of which, Sandy Flat, has been mined on a small scale. The company is seeking to identify more, larger pipes that do not outcrop.

Rex Minerals Ltd – RXM

| Price (c) | 52 Week Low | 52 Week High | Shares (M) | MCAP (M) |

| 13.5 | 2.6 | 26 | 376 | 51 |

| 38.5 | 5.7 | 39 | 422 | 163 |

| Share Price Change 285% |

The company holds the Hillside copper project in SA, it also has a substantial gold project at Hog Ranch in Nevada. The Hillside resource is 337Mt @ 0.6% copper and 0.14g/t gold. A FS updated in 2020 gave robust results. An AISC of USD1.60/lb and annual EBITDA of AUD152M. The mine life is +13 years. The company is seeking finance and JV partners.

Stavely Minerals – SVY

| Price (c) | 52 Week Low | 52 Week High | Shares (M) | MCAP (M) |

| 95 | 26.5 | 122 | 261 | 248 |

| 65 | 38 | 96 | 261 | 170 |

| Share Price Change 68% |

The Stavely project is located in Western Victoria on the Stavely tablelands. It hosts a chalcocite resource of 28Mt @ 0.4% copper at Thursday’s Gossan. However, of more significance is the discovery of a high grade lode, the Cayley Lode. It was discovered in late 2019 and is still being drilled out, there is not yet a resource. However, it will be large and high grade in copper, along with gold and silver.

Venturex Resources – VXR

| Price (c) | 52 Week Low | 52 Week High | Shares (M) | MCAP (M) |

| 11.5 | 4.7 | 15.5 | 384 | 44 |

| 72 | 4.7 | 79 | 420 | 305 |

| Share Price Change 626% |

The Sulphur Springs project is located in the Pilbara region of WA. It hosts a resource of 13.8Mt @1.5% copper, 3.8% zinc & 17g/t silver. The deposit was discovered many years ago and was acquired by Venturex in 2012, along with the smaller Kangaroo Caves deposit. A DFS was completed in 2018 and mining plan in 2020. The company is now at the stage of finalising design, engineering and offtake and finance.