Worth Watching III: India Fund Limited (expected list date is 6 July 2015 – ASX: INF)

On Thursday I attended an investor briefing on India Fund Limited, hosted by Monsoon Communications. The event was well attended and lunch was, fittingly, curry with rice.

Managing Director, Mr John Peireira, was born in India and has lived for many years in Australia. He has a very strong board, with particular weight on corporate governance. I consider this to be important for such a fund, it is a big plus for the shareholder.

John has form in this area. He previously floated India Equities Fund Limited, which listed on ASX in 2007. Just in time for the global meltdown. He gave shareholders the opportunity to wind the fund up, which they took. The return was 90 cents on the dollar. A very good result considering the conditions at the time. That says a lot about the man.

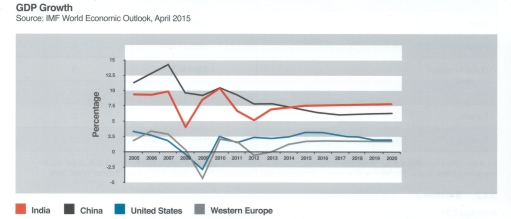

India is, of course, one of the world’s great growth stories. In particular, the new government of Mr Narendra Modi has implemented wide ranging reform. This has resulted in increased business confidence, and increased foreign investment. Even the prized railway system is open for privatisation.

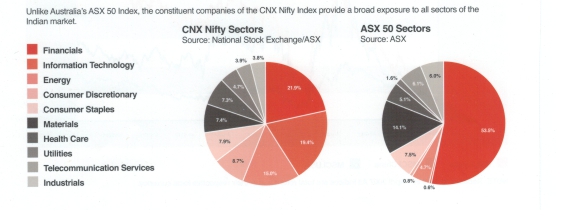

The three charts below (courtesy INF) support the growth story. Of particular interest to me is the balance between various sectors of the Indian stock market, compared with our overdependence, in Australia, on the finance sector. Something I have posted on here and here.

The fund will be invested 65% stocks and 35% fixed interest. Indian stocks return an average dividend of around 2%, Indian government bonds are currently returning 8-9%, quality corporate bonds around 11%. The fund is expected to pay a dividend of around 4%, based on the above numbers.

Finally, the fund will be exposed to the rupee. While conventional thought is for ongoing strength in the rupee and further weakness in the AUD, it is a risk that may not suit all.

Conclusion

- A strong board

- Extraordinary Indian economic growth

- A popular, reforming Indian government

Worth a look

NOTE

My “Worth Watching” series is a brief review of corporate presentations that appeal to me. They are not based on in-depth research and are in no way a recommendation to buy or sell shares. The reader is advised to do their own research and/or consult with their broker.