The Petrodollar: All Good Things Come to an End

President Richard Nixon introduced the petrodollar in 1974 to allow continuation of the dollar as the world’s reserve currency. A brilliant economic strategy. Read more here.

Since I last wrote about the petrodollar in February this year, America has managed to alienate both Russia and China. The first with the Ukraine affair, the latter with an official visit to Japan, Korea and the Philippines, but not China. They alienated Qatar too, with the threat to export natural gas into Qatar’s markets.

The Americans have previously alienated Venezuela, Iran and Saudi Arabia. Of course, many other countries are not best friends with the US either.

Difficult to pick the strategy here, but America now has countries with most of the world’s energy reserves off-side. This suggests that decline of the petrodollar is nigh.

While Russia, China and Iran have previously suggested moves away from the US dollar, nothing concrete has happened until recently. Last month Russia officially confirmed that it will move away from pricing oil and gas in the petrodollar.

Vladimir Putin will be in Beijing next week, on May 20. Perhaps one outcome will be energy pricing in rouble and yuan. It is possible gold will also play a part.

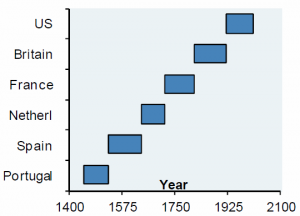

The chart below shows the duration of the world’s reserve currencies since Portugal in the 1400’s. The duration of the petrodollar is comparable to that of previous reserve currencies. The end may not be soon, but it will come.

What comes next? It could be a single currency or a basket of currencies, or even a basket of commodities. In this regard it is interesting to note that around 40 central banks hold yuan and most continue to add to their holdings. While the US dollar still dominates, its share of reserve currency holdings has been declining since 2000.

LAST WORD

The transition to a new reserve currency will be slow, but it will happen, and it will influence investment choices worldwide. The upshot is that over time the US dollar will decline against other currencies. Having said that, there are pros and cons to being the world’s reserve currency.