LME Stocks do not Reflect Physical Supply/Demand

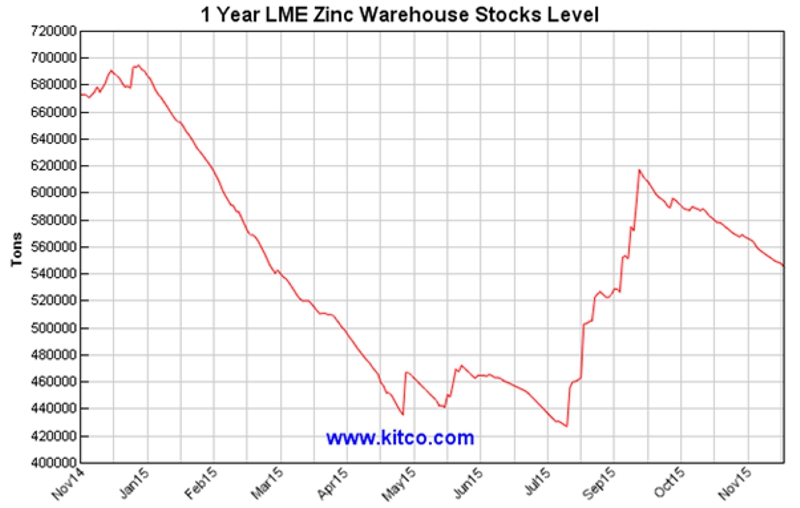

There is a common belief that London Metal Exchange (“LME”) stocks of metal reflect the underlying, physical supply/demand balance for that metal. For example, at the beginning of 2015 LME stocks of zinc plunged from 700,000 tons to 440,000 tons over a five month period. This was taken as a sign that there would soon be a shortage of physical zinc and prices would therefore rise. Then stocks promptly rose back up to 620,000 tons.

In fact there is little relationship between LME stocks and physical supply and demand. This can be seen by comparing the following two charts of the spot zinc price and LME warehouse stocks.

The LME only holds a part of the world’s available metal supply. There are competing metal exchanges (such as the Shanghai Metal Exchange) and competing warehouses that can offer lower storage costs than the LME.

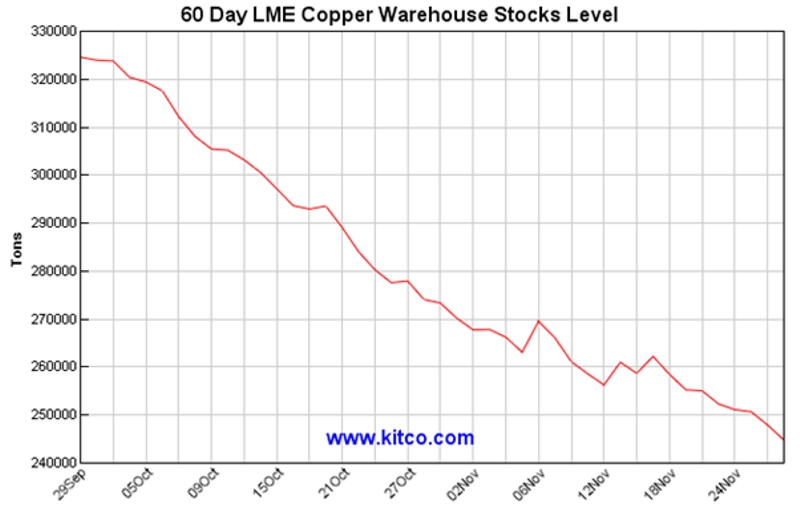

Metal producers also periodically retain metal in the expectation of higher prices. This has been happening in China over the last two months with copper. This hoarding can then put downward pressure on warehouse stocks, as shown for LME copper stocks below.

In conclusion, LME stock movements are primarily a function of financing and warehousing competition. This competition can lead to rapid movement in or out of LME warehouses. Such stock movement is not a proxy for future metal price trends.

All charts courtesy Kitco