Global Shipping is a Disaster

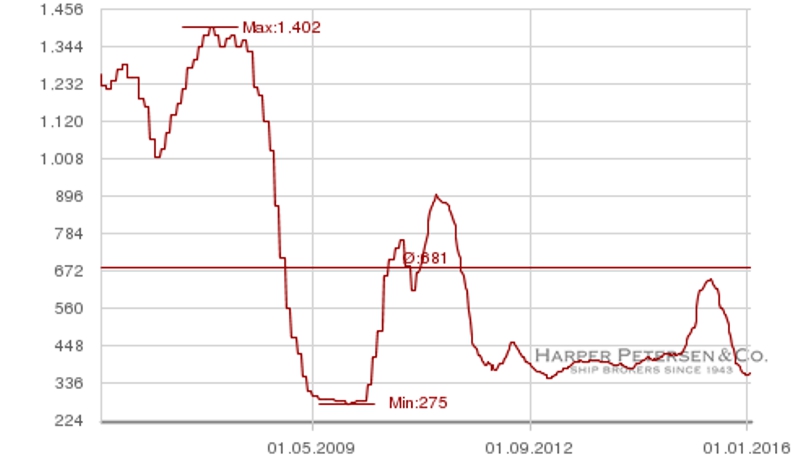

Commercial shipping of all types is rapidly heading underwater. The containership market is almost back to the lows of the 2008 financial crisis, as measured by the Harpex Index. Bulk dry cargo rates are at the lowest ever, as measured by the Baltic Dry Index. Both charts are shown below. This state of play is a combination of increased ship supply coinciding with rapidly falling demand, especially from China.

The shipping market is comparable to the iron ore market, where new supply is still coming online, just as demand falls through the floor. Iron ore prices are low because steel demand has evaporated. One of the flow-on effects of low steel prices has been that, in some cases, the scrapping of old ships would return a negative income.

The shipping industry is in chaos. Often times freight rates are insufficient to cover even the mortgages on ships. Bankruptcy among ship owners is on the rise, as are cut price ship sales. There was a report last week that you could hire a smaller container vessel for a little more that USD1,000/day. Two weeks ago it was reported by Marine Traffic that there were no cargo ships in the North Atlantic. This is unheard of. Marine Traffic is a great site that interactively shows the position and movement of commercial vessels, with a database of over 600,000 vessels.

The state of commercial shipping is a huge red flag for the future of the global economy. It is a real indicator of economic health, divorced from the monetary voodoo of central banks. Read about the composition of the Baltic Dry Index here, and previous views on the index here and here.