The Economic Reality of Geology: Part One

Modern, industrial economies are built on a foundation of plentiful, high quality, low-cost, energy and minerals. No amount of technology will change this dependence.

For example, about a third of US electricity is generated by coal. Thus many electric cars are actually “coal fired” cars. The manufacture of solar cells requires a whole suite of minerals that need to be mined, processed and refined before use. That requires energy, and much of that energy is from coal.

Mineral and energy deposits tend to have a Paretian (after Vilfredo Pareto) distribution. That is: very few large, high value deposits; some of medium value; and many small, poor quality deposits. Thus there is a “long tail”. Costs of discovery, extraction and processing are just as important as size and grade. A large deposit with high costs (or poor quality) will effectively be a small deposit, in terms of profitability.

The chart below is an example of Paretian distribution. In business, this is also known as the 80/20 rule. An example: 20% of your salespeople create 80% of your revenue.

Charts Courtesy Max Tobiasen

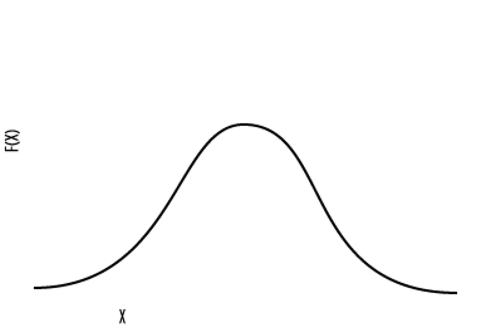

The chart below is a “normal” distribution. An example of a normal distribution would be the distribution of height in a population of people . One of the very real issues in the investment universe is that many people incorrectly assume all distributions are normal.

A good example of Paretian distribution in minerals is the distribution of Volcanogenic Massive Sulphide Deposits (“VMS” -copper, lead, and zinc). Typically the largest deposit in a system is discovered first. Because it is the biggest, it is the easiest to find. It is rare that other deposits in the system approach the largest in value (grade, size etc.), and most are small and sub-economic.

The promoters of such systems always assume that when a big one has been found, there are other big deposits just waiting to be found. this is not so. Read more on VMS distribution here.

The Paretian distribution of mineral and energy deposits has some serious future consequences. Because the most valuable deposits have already been found and exploited, future discoveries are likely to be smaller and more costly to exploit.

By way of example, the oil majors have had a really poor discovery rate over recent years, and as a result have curtailed exploration for new deposits. And discoveries that have been made are much more expensive to develop. This will inevitably lead to much higher oil prices in the years ahead.

Conclusion

The minerals and energy that power society will not get cheaper and will not be replaced by “technology”. Unless, perhaps, nuclear fusion becomes a reality rather than a dream. And then I will want my (anti)gravity boots.

We have already seen the peak in oil production – read more here. Our best defence is conservation: of energy, water, everything. This is where technology plays a great role. Cars and domestic appliances are vastly more efficient today than even 5 years ago. This won’t avoid the issue of Paretian distribution, but it will delay the inevitable.